Mortgage Requirements

Mortgage criteria for an individual app is generally so much more strict, requiring a robust individual economic profile. To and obtain home financing in australia, a deposit regarding ten-20% will become necessary, which have the absolute minimum deposit from 20% required to avoid expenses lender’s home loan insurance (LMI).

Being conscious of the borrowed funds standards and you can ensuring that you meet all of them is very important when selecting a property instead a partner.

Search professional advice out-of economic planners, lenders eg Soho Home loans, and you can lawyers understand the fresh implications together with procedure of to get a home without a spouse.

Potential Enough time-Name Outcomes

- The potential for a decrease in the value of the home

- The opportunity of a fall in the borrower’s credit history

- The chance of a decrease in this new borrower’s capacity to and get upcoming money

- Marital assets, together with property acquired without a spouse, are at the mercy of assets section in case of break up otherwise breakup.

Because of the given these possible enough time-title outcomes and you can and then make a knowledgeable decision, you could potentially most readily useful manage your own interests and make certain a profitable property acquisition.

De- Facto Relationships and Property Ownership

De facto matchmaking and you can possessions ownership around australia cover specific significance and you will property legal rights. Wisdom this type of issues might help manage your passions and ensure a good easy possessions buy process in the eventuality of an effective de- facto relationship.

https://paydayloanalabama.com/killen/

Definition of De- Facto Dating

An effective de- facto relationships is defined as one or two single anyone life style together during the a married relationship-particularly matchmaking, irrespective of gender. You should see the concept of the expression de- facto relationship’.

Possessions Legal rights within the De Facto Relationship

Possessions legal rights from inside the de facto matchmaking would be complex, that have low-getting lovers potentially that have a claim to a share of your own possessions based on certain situations, such as for instance economic benefits and Loved ones Legislation Work.

This new criteria having an effective de facto companion for a claim so you can property payment, along with property, in Loved ones Rules Work is in depth as follows:

- Which have lived to one another getting a significant several months (fundamentally 24 months or maybe more)

- Having a genuine domestic relationship

- Which have financial and/or child-relevant issues to-be solved.

Whenever isolating assets when you look at the a beneficial de facto relationship, it’s important so you can 1st select and you can assess the property and obligations of each team. As well, another products is going to be considered:

- Economic benefits

- Non-economic benefits

From the wisdom assets rights from inside the de- facto dating, you could potentially best manage your own passions and ensure a fair possessions office in case of breakup or breakup.

There are reason why a single might want to get a home as opposed to the spouse in australia. These could are a poor credit score, overwhelming debt, otherwise a desire to take care of separate earnings.

It’s important to know such explanations and exactly how they might impact your decision purchasing a house versus your wife.

Graph The right path: Trying out the house or property field unicamente? Our very own writeup on to buy a property while the one woman inside the Australia provides pointers, resources, and help for the excursion.

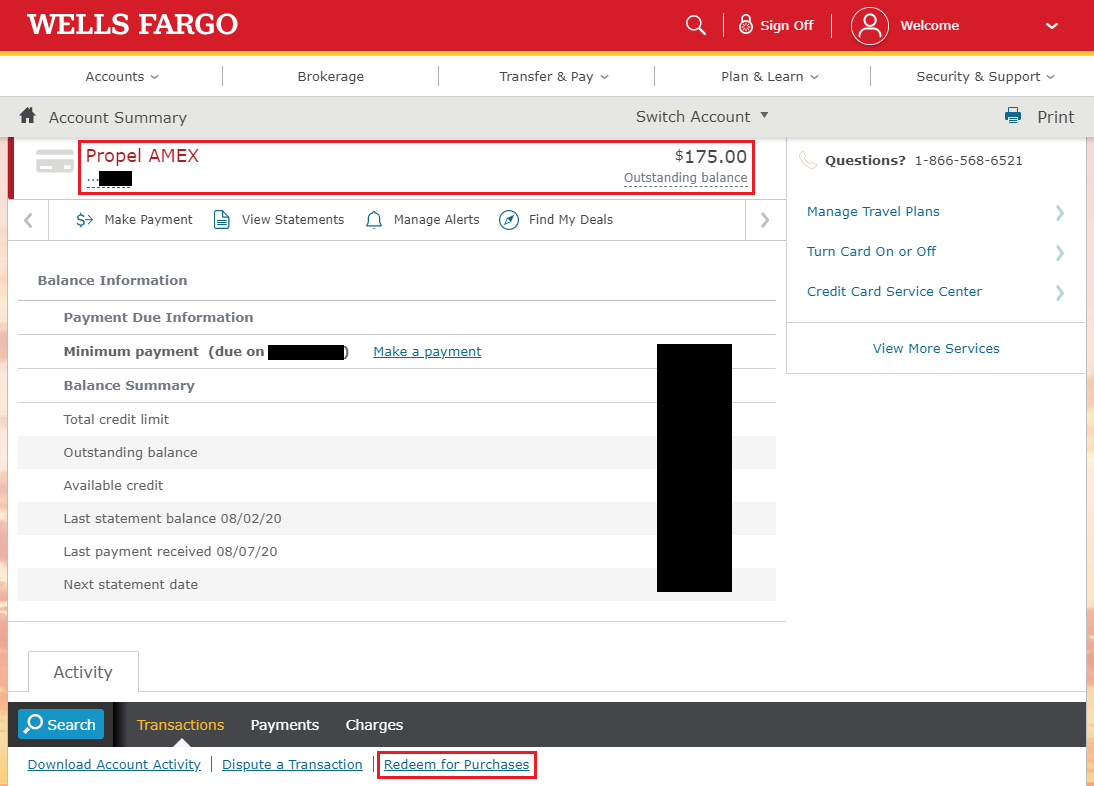

Bad credit Get

A spouse’s less than perfect credit score can have a detrimental affect a shared mortgage application, causing high interest levels otherwise getting rejected.

In the event your companion has actually a history of bankruptcy proceeding or property foreclosure, otherwise a massive loans that affects their creditworthiness, creditors could possibly get refuse the shared loan application.

Furthermore, a low-existent credit score can be viewed as a threat from the banks, increasing the probability of their home loan app are denied. Hence, trying to get a home loan individually can be a better option in the event that you to definitely lover have a minimal credit score.