Creator regarding SoCal Va Belongings

A Virtual assistant loan Preapproval in purest mode is an actual conditional dedication to give, provided from a beneficial Virtual assistant mortgage underwriter, helping a loan provider. After you’ve attained their Va mortgage preapproval, you may be in fact ready to purchase and you will romantic timely, so long as the house match the latest lender’s criteria.

not, not all lenders tend to underwrite an excellent Virtual assistant loan document having good property Is Determined or TBD. That it most crucial step is significantly regarding work, and it can not create a shut loan while there is not assets but really. This has been an unneeded even more action. Although not, to own Va consumers with limited borrowing from the bank the additional energy is highly necessary given that credit file has already been assessed by the underwriter.

Instead of an excellent prequalification, an excellent preapproval is set on genuine Va loan underwriter’s over overview of the latest borrower’s paperwork, not just relying upon all the info tend to only talked about on cell phone between the debtor and you will a loan administrator. Lower than, we are going to talk about the strategies to get an excellent Virtual assistant loan preapproval…not just an effective Va loan Prequalification.

See that it short term films having a simple cause of your differences ranging from a beneficial Va Mortgage Pre-Recognition versus. a Va Financing Pre-Qualification:

Va Financing Prequalification

When a seasoned becomes pre-entitled to a good Virtual assistant home loan, they might be available with a quote of your financing size they would manage to get to. These rates are supplied based on first pointers new Veteran brings, will from an extremely temporary talk with a loan administrator. Which talk in addition to will not necessitate a credit score assessment. A definite verification of your own borrowing from the bank reputation and fico scores are always recommended, specifically for Authorities loans particularly good Va loan.

Contemplate an excellent Va loan prequalification while the basic restricted step and this sometimes might occur before real Va loan preapproval when you look at the new homebuying process. You can just rating a standard sense of your to order power after that begin wanting a property. But bringing the extra methods are usually necessary to introduce good experience of a reputable lender who will up coming point a strong letter showing your qualifications because an excellent Virtual assistant consumer.

Whenever you are asking ways to get preapproved to possess a good Va house loan, we will provide the half dozen small & simple actions here:

Pre-Recognition against Pre-Qualification: Very important Technology Differences!

While most world people and you will borrowers make use of the terms and conditions pre-approval and you will pre-qualification interchangeably, there are lots of essential variations to consider.

A great Virtual assistant mortgage Prequalification normally is performed by the a loan administrator, and therefore craft might not tend to be a credit assessment a giant ability into the recognition techniques. Personal debt so you can earnings ratios can be determined in this pastime, however, depend on can’t be placed on a leading financial obligation proportion situation without needing the requirements off Automatic Underwriting.

There is absolutely no option to this action. A staff at the bank have to obtain an excellent tri-combine credit history while the resulting credit ratings away from each of the three credit bureaus. Unfortuitously, the new AUS or Automatic Underwriting System would be work at by the one staff from the lender, nevertheless the ethics and you will legitimacy of the Automatic Underwriting Analysis results need to be confirmed from the an excellent Va Underwriter. The new AUS application most frequently made use of is named Desktop computer Underwriter.

A lot of errors can be made within techniques from the newbie members, but those deadly problems is exposed of the underwriter That’s what They actually do! Just in case the new mistake it’s is actually deadly, the loan might be declined. When you find yourself for the escrow to shop for, this isn’t a lot of fun to find out you do not qualify!

A highly high most of the fresh new Va financing Preapproval results are brought to consumers from the loan officers utilising the AUS software on their own, most in the place of supervision. A unique user for the product can learn how to efforts the software program in only a matter of times and get some proficient in just months.

A word of Caution…as an unknowing Virtual assistant borrower, you would not determine if that it affiliate has included deadly problems. Anyone can input the knowledge into the application! Every borrows won’t be the same. You to civilian paystub are going to be simple, and some was infamously tricky, just as are several self-employed taxation statements. Thus, mistakes to the money, loans rations, continual income requirements and more can easily be part of the preapproval.

This is certainly a classic trash within the, trash away situation, in which the result is simply just like the feel of the software operator. When the an inexperienced mortgage administrator helps make an error and you may supplies good Virtual assistant loan preapproval letter for your requirements, it might not getting credible, best you down a sad roadway, lead having americash loans Istachatta trouble.

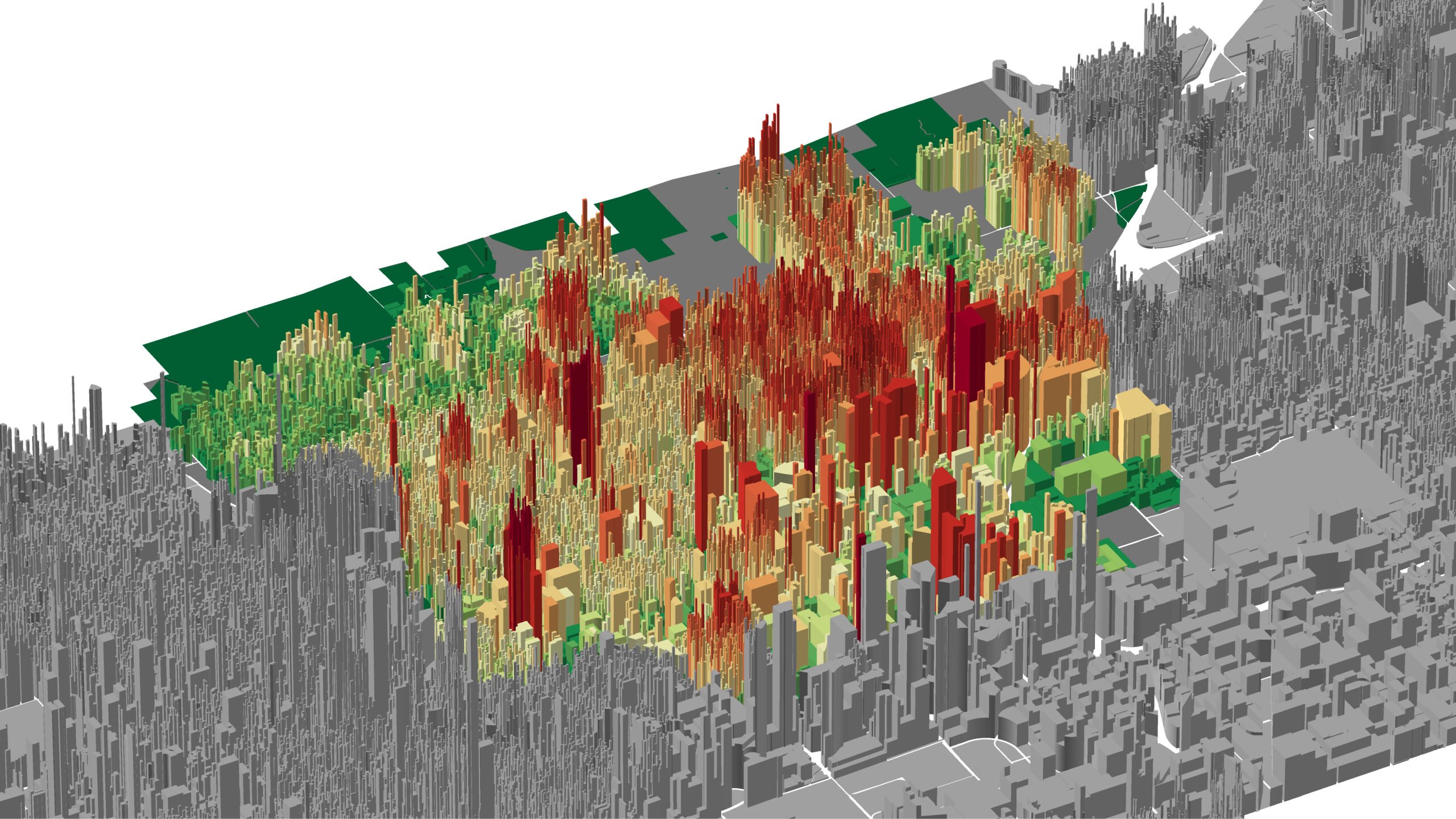

Pre-Recognition against. Pre-Certification Chart

The next chart usually break apart the difference ranging from pre-certification and you can pre-approval if you are responding specific faq’s about the Va domestic financing process:

During the SoCal Va House, we’re invested in help you from the Virtual assistant mortgage prequalification techniques as much as an excellent TBD pre-acceptance, when needed. I exceed to truly get you properly accredited and you may and also make your now offers attractive! I make the procedure much easier and you may send greater outcomes with these unique and you will effective apps.

Va Financial Prequalification Calculator

I’ve a variety of calculators to aid their preapproval to possess good Va mortgage. Our very own Virtual assistant home loan calculator helps you guess payments. And you may all of our other calculator may serve as good Va financial prequalification calculator, whilst stops working your funds and teaches you your debt rates.

Get your Va Home loan Preapproval Now!

Sr. Virtual assistant Financing Benefits is actually here so you can last, together with Peter Van Brady who had written the key book towards the Va loans: To avoid Errors & Smashing The Selling Using your Va Financing.