Secured loans normally have straight down interest levels but feature brand new danger of losing new security, which in the truth of family equity funds and you can HELOCs, will be your household. Signature loans provides high prices however, zero collateral chance. Personal do it yourself fund features a very sleek application for the loan procedure, ensure it is faster usage of money, and also have little to no credit costs. Collateralized house collateral funds take more time to fund and encompass a lot more documentation and you may running.

- How much cash do you need to acquire, and just how in the near future do you need the money?

- Would you brain paying closing costs and you may origination charge?

- Are you currently doing the fresh renovations on your own? In that case, do the lending company allow it to?

- Are you presently comfy making use of your house since the guarantee?

Bank Look and you can Openness

Only a few lenders supply the exact same financing possibilities, terms, prices, and you may qualification direction. Before you sign the borrowed funds arrangement, feedback its products, standards, and you can borrower viewpoints.

Researching Financial Strategies and Principles

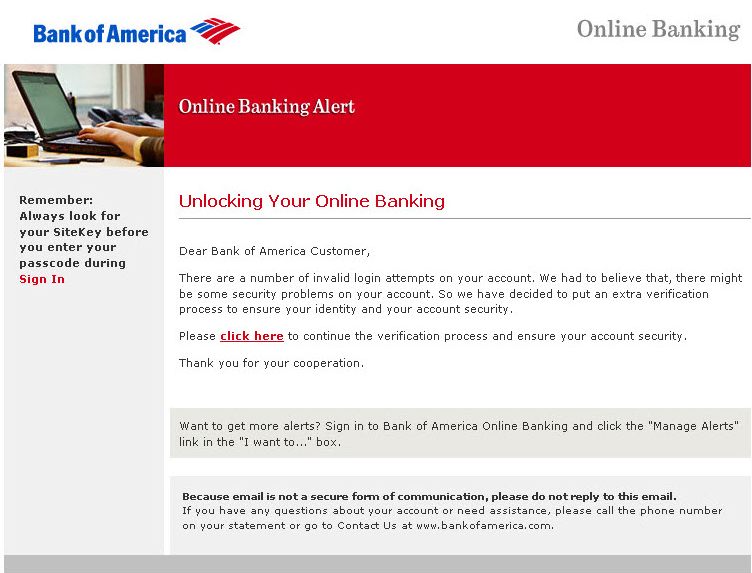

Comparing and you may information an effective lender’s means, principles, and you will customers ratings is a vital help searching for a trusting credit experience. Comment its formula and you can disclosures on the internet otherwise get in touch with all of them in person. Comprehend comments from customers on the opinion programs and you may social networking. Observe how it deal with bad viewpoints to see activities in online payday loans Virginia the the new problems.

Significance of Transparency and you can Customer care

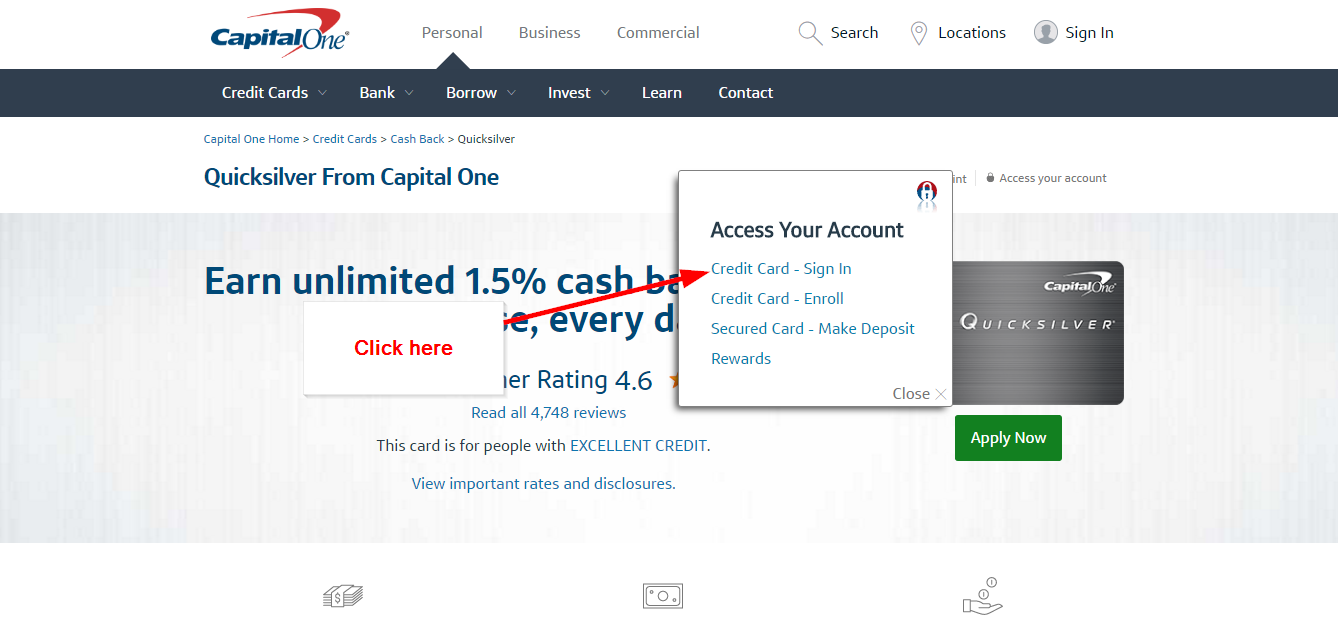

Visibility inside the charges, pricing, and you may conditions, along with higher customer service, are very important inside good bank. Consider the website to find out if they give you obvious factual statements about their fees and you can conditions. You are and also make loan money for many years, so find a loan provider you’ll keep in touch with and you may viewpoints your own relationships.

Regulating Considerations

It is also essential prefer a loan provider one to abides by regulatory conditions to make certain a secure and you can reasonable borrowing from the bank experience. If you utilize your house due to the fact guarantee, defaulting might have a devastating results – losing your residence. Federal and state enterprises protect property owners by creating yes lenders was during the compliance having facets instance disclosures, loan modifications, and you can transparent terms and conditions.

Government Programs and you may Tax Credit

Conventional lenders aren’t your only option. Your s and you can income tax loans. Bodies guidance software tend to have down prices and less stringent qualification standards.

Government Homes Administration (FHA) Programs

FHA programs offer various choices for home improvement financial support, also financing for time-effective updates. However, never assume all lenders promote these fund. See the U.S. Agencies off Property and you can Urban Innovation webpages to have a list of accredited money providers.

- Title step one financing : An effective HUD-covered loan granted of the an exclusive lender having renovations to help you a home you occupied going back 3 months.

- Energy-successful mortgage: Set aside having time-productive home improvements.

- FHA Rehab Financing: Called a beneficial FHA 203(k) loan can be obtained having homes more than a year-old that want at least $5,000 within the home improvements.

Energy-Productive Condition and you may Credit

- Replacing windows and doors.

- Establishing solar power roofing.

- Upgrading your Hvac system.

State government Recommendations Apps

Local government programs can offer extra capital options otherwise incentives for home improvements, particularly for energy savings upgrades. The availability of authorities gives may differ because of the state and relies on finances information.

Final thoughts

You could potentially loans your house restoration tactics due to individuals do it yourself loans. Using your house’s collateral was an advantage off homeownership, but you is always to meticulously comment the dangers and gurus prior to signing for the dotted range. Do it yourself funds is actually an important product for getting the credit you need to enhance the worthy of and you may functionality of your property, if you find yourself helping you ensure it is your. Knowing the items, terms and conditions, and you can possibilities is extremely important to make an informed decision.