Express This post:

Personal loan providers provide crucial capital options for a property investors. Yet not, there are many different mythology and you may misconceptions close the new certification laws and regulations to own private loan providers, particularly in Team Objective Credit (BPL) safeguarded from the domestic a property. Believe it or not, several states in america want a license to have for example credit circumstances. Knowing the specific standards, debt, and you can complexities associated with certification inside for each and every condition is extremely important getting your success. This informative article aims to demystify the official-by-condition way of certification, high light key criteria in some claims, and stress the importance of careful consideration in order to browse new licensing procedure effectively.

The state-Specific Landscape

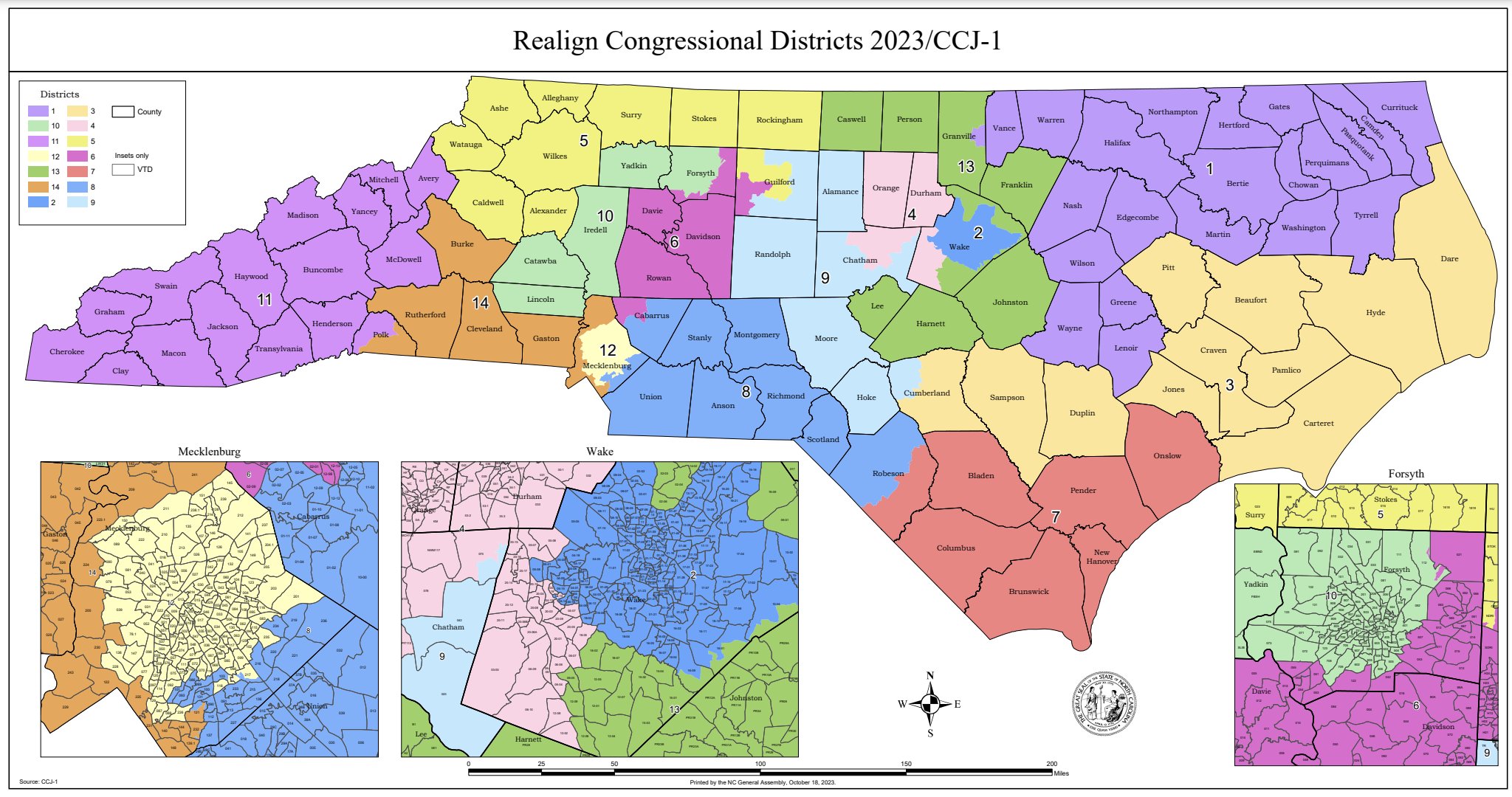

Since a personal lender, it is critical to know the certification standards during the new says where you operate. Getting non-owner-filled BPL, such claims wanted a license to help you lend: California, Washington, Las vegas, Utah, Idaho, Oregon, Minnesota, South Dakota, North Dakota, and you may New york. In addition, states such as for instance Fl, Tennessee, Vermont, Washington, and you can Colorado impose more personal debt beyond licensure. These financial obligation vary from exceptions, special laws regarding owner-occupied BPL, usury, bonding, or particular exemptions that you must adhere.

Navigating Novel Checklists

Licensing criteria include state to state, and each state preserves its own book number. It is crucial is better-prepared and learn these types of checklists to get rid of too many burdens in app procedure. Such as, getting a washington Home loan Banker’s permit needs a qualified employee residing in the Washington, audited financials, a stone-and-mortar work environment when you look at the Arizona, and Mortgage loan Originators (MLOs). Similarly, Utah’s Home loan Licenses necessitates a financing manager with plenty of mortgage sense and you will MLOs. Understanding and therefore claims require MLOs and you may that don’t is an more level from difficulty.

Dependence on Record Look at Legislation

Understanding for every nation’s record check statutes is the key having a successful software. Other says keeps different regulations out-of which should provide a background seek out candidates. Although cash advance Tall Timber it is typical getting handle persons add to record inspections, control is generally a complex topic. Particular states require anyone who possess ten% or even more of your candidate add to a back ground glance at. Anybody else are those you to definitely individual over 20% away from voting welfare. Ultimately, certain claims requires more credit checks also background checks. With your considerations, the applicant need strategize prior to the program.

Beating Challenges and Subtleties

One of the high challenges one individual loan providers face ‘s the insufficient expertise certainly one of states, particularly in non-urban segments, regarding your difference between Providers Purpose Home-based Mortgages and you can simple mortgage loans. Current activities which have condition examiners when you look at the Minnesota showcased 1st difficulties in recognize ranging from these two house categories. But not, as a result of an interpretive techniques, Minnesota approved you to BPL financing does not wanted MLOs since it does not have a consumer component. Which decreased expertise underscores the necessity for personal lenders to browse the applying process with caution and you may clarity.

Entry Exact Software

Given the nuanced character off BPL certification, distribution programs with careful proper care is key. Certain says, particularly Ca, associate residential home loan which have consumer-objective financial credit, if you find yourself pinpointing commercial because the BPL. Misclassifying their lending issues can result in improved burdens and potential problem. Such, when applying for the latest California Financial support Law Licenses (CFLL), private loan providers can opt for the new Commercial variation, which includes less online well worth requirement and does not demand MLOs. Pinpointing once the good residential mortgage lender you certainly will subject one to higher standards, since NMLS program and authorities could possibly get imagine you are a great user home loan company. Rather, the fresh new CFLL app process currently is definitely the lengthiest certainly one of the new says. Already, it is taking over seven (8) weeks for CFLL approvals, that have current requests document trials eg mortgage plans and you can related disclosures likely contributing to so it significant extension from inside the control big date.

Completion

Since a personal financial, navigating the fresh new network from licensing guidelines to possess Providers Purpose Lending shielded by residential a home is essential for the continued achievements and you may conformity having state laws. Because of the understanding the state-certain surroundings, book checklists, MLO criteria, and you will records check statutes, you can streamline the fresh new licensing techniques and avoid too many burdens.

It is essential to approach for every single state’s licensing standards that have diligence and you can meticulous thinking. Distress and you may misconceptions nearby BPL and its own differences off standard mortgages is also complicate the program process. Get in touch with the team at Geraci right now to make sure you was compliant with all state certification and you will financing requirements.