Whether it is to own an emergency or even pay money for your own expenditures, unsecured loans are going to be a life saver for some Canadians. However, all round belief is that you could merely score genuine personal financing from the huge banking companies and large loan providers. However, finance companies are not the only and/or better economic place to get your next financing.

One benefit from applying for that loan off a great borrowing from the bank union including Innovation is the fact your loan are customized in order to your role. You desire financing timely? You could potentially apply in minutes. You prefer flexible payment solutions? Also, they are readily available. You could generate profits dividends on your loan so you’re actually making money if you are credit currency.

Credit unions was member-owned plus don’t take advantage of putting the users during the disadvantageous positions on account of a personal bank loan. Hence, these are typically more inclined to give your that loan that is right for the disease which makes up any potential pitfalls that you are going to occur inside pay procedure.

Ought i get a card relationship financing to expend charge card obligations?

Why must some body take out an unsecured loan to repay credit card debt? The key reason was debt consolidation reduction. Debt consolidation reduction is the act away from moving your personal debt to help you you to definitely place making it more straightforward to monitor and you can manage. Others added bonus from taking out fully an unsecured loan is that the interest rates into the finance are below brand new cost towards a credit card. Credit unions eg Innovation can frequently offer higher interest rates and flexible commission choice which make repaying the debt much much easier.

Now you understand why you may choose an unsecured loan, but if you get that? Step one is to try to query if you be eligible for an excellent personal loan. Having good credit and capacity to borrow often greatly improve your probability of bringing a consumer loan.

Subsequently, need a personal bank loan large enough to pay for all your credit debt. Otherwise, you will need to pay a couple financing of at the same time. Might you be eligible for the loan count you want?

Therefore the latest question you need to believe try are you willing to has actually a strategy for settling a loan?

When your response is yes to your more than, you’d almost certainly benefit from taking out fully a credit relationship loan to repay the credit card debt. In case you’re nevertheless unsure, contact us to find out more.

That are a knowledgeable team getting small loans for bad credit De Beque fund from inside the Canada?

You imagine big banking companies offer great small financing alternatives for Canadians. They are a trusting supply and provide use of during the-person or over-the-cellular phone customer care.

You’ll be able to be thinking an online bank otherwise financial. Of several online organizations give finest pricing than simply its big financial alternatives and then have a lot more solutions in terms of the mortgage amount.

Innovation, yet not, is just one of the top organization out of unsecured loans. The application techniques is fast, and you are provided numerous versatile fee possibilities very you are not caught that have that loan you can not pay off. Also, our services provides a personal touching you may not found of other financial institutions. And you secure profit-sharing bucks by simply that have a loan with our company.

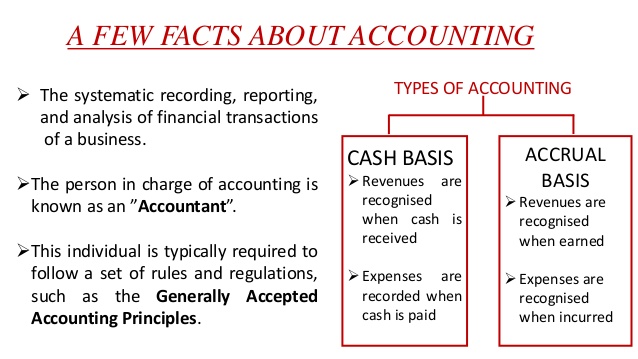

Exactly how is the total attract to your a consumer loan computed?

When taking aside that loan, you are billed an interest rate. Situations such as your credit score and you may loan amount may differ the eye you are billed.

You can use a loan calculator to choose how much full appeal it’ll cost you in your personal bank loan.

Understanding Borrowing Union Funds

Make sure to look at the what interest and extra benefits a financial institution provides prior to taking away another type of consumer loan. And, ponder when it providers features your absolute best demand for attention or perhaps is merely trying to make currency off you.

By firmly taking these required steps and you may shop around, you’re sure to obtain the lending techniques simple and easy of good use.