Idaho produces an effective spot to relax to have experts and active-obligations services professionals by discount away from living it also offers. Regardless if you are thinking of moving Idaho otherwise an existing citizen, to find a different residence is a vibrant opportunity for a new begin. And, if you’re a seasoned or service representative, it can save you on your financial which have an enthusiastic Idaho Virtual assistant domestic financing.

There are numerous benefits of trying to get Va home loans in the Idaho, along with 0% down payment, straight down interest levels, and a simple approval process having Griffin Financing.

Section We Serve

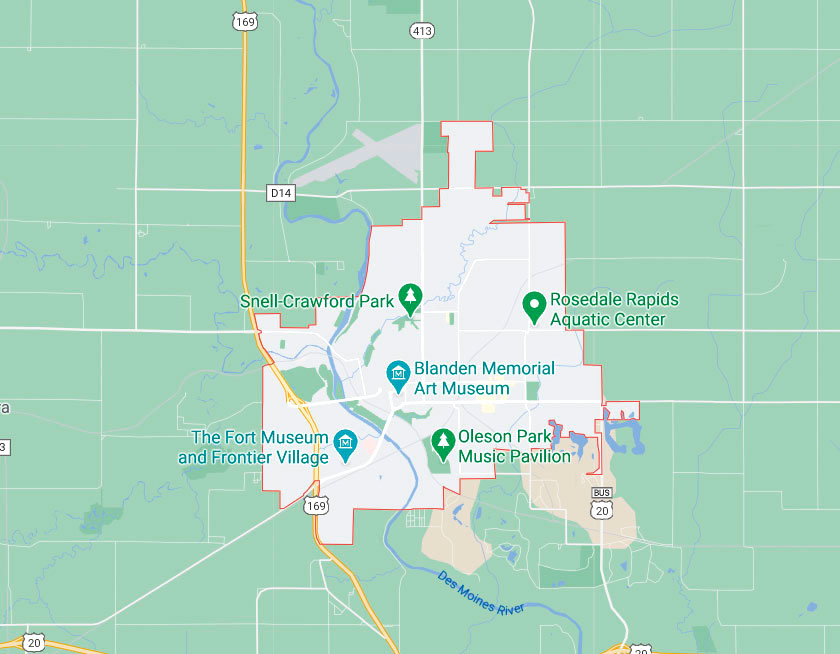

Griffin Financing is seriously interested in offering all of our Idaho pros and bringing them with the best finance to enable them to get to its requirements. Whether you are finding home financing services during the Boise, ID, or Nampa, ID, we are able to let. We provide Virtual assistant fund on following the portion:

- Boise City

- Meridian

- Nampa

- Idaho Drops

- Caldwell

- Pocatello

- Coeur d’Alene

- Dual Falls

- Article Falls

The audience is licensed to include funds to all the Idaho customers, just those people noted, therefore make sure you give us a call to go over your options for Va money.

Va lenders functions the same exact way inside the Idaho that they manage in almost any most other county. This type of loans, if you find yourself secured from the Agency away from Veterans Issues (VA) aren’t readily available through the Va. Instead, you will need to proceed through an exclusive lender otherwise non-financial bank.

When making an application for home financing, try to meet a couple sets of conditions to-be approved: the fresh VA’s standards and also the criteria of your bank. To make the acceptance process because the smooth that you can, follow these types of procedures:

Once you make an application for an excellent Virtual assistant buy financing, you’ll get the loan recognition in 24 hours or less. Together with your recognition at hand, you can move on which have getting the household your chosen.

Va Mortgage Pros within the Idaho

Va funds can be found while they give solution players and you can veterans with professionals one regular civilians don’t get. Va pros in the Idaho become:

If you would like start enjoying the newest advantages out-of a good Va loan, call us quickly or start completing the online application.

Virtual assistant Mortgage Constraints into the Idaho

Va mortgage limitations don’t apply at pros or provider people making use of their complete mortgage entitlement. Virtual assistant financing constraints nonetheless connect with individuals with reduced Va entitlement.

Since the Va doesn’t restrict how much money you could obtain away from a lender, it can reduce next level of the borrowed funds that you can receive without placing hardly any money down.

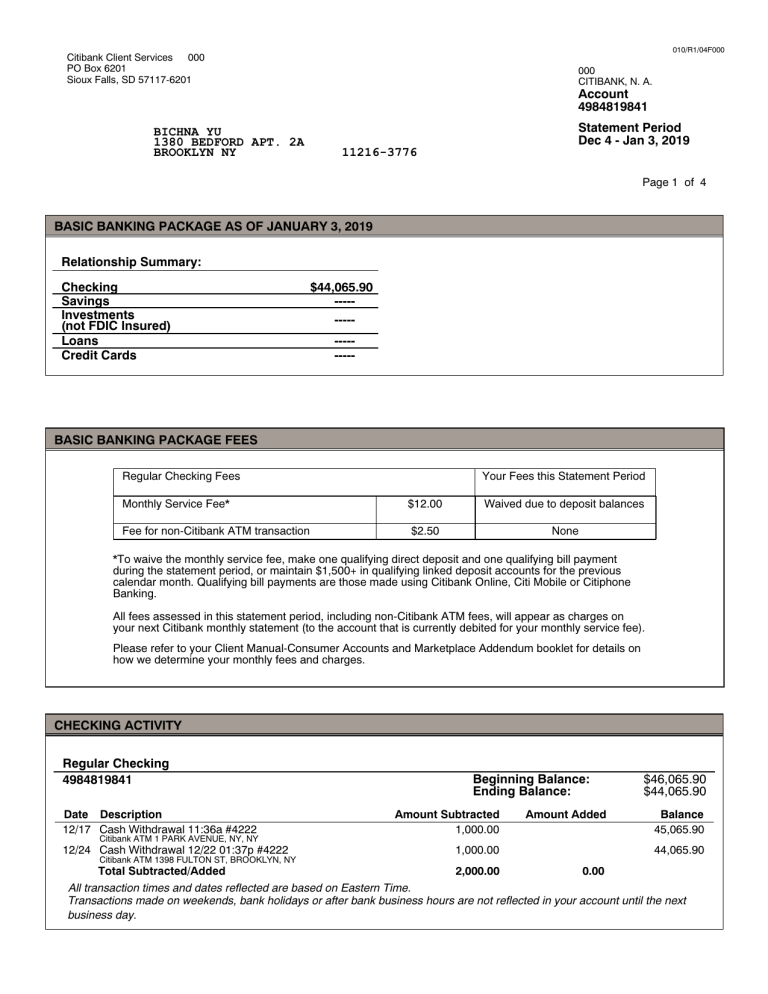

Va financing restrictions are determined by state the spot where the house is receive. Financing constraints getting Idaho counties is:

Conditions to possess Virtual assistant Mortgage brokers from inside the Idaho

Idaho Va financing conditions vary from antique lenders because they’re generally much more flexible. Some of the qualifications criteria are:

Low Credit rating Requirement

Compared to a traditional home loan, Virtual assistant money require lower credit ratings regarding individuals. The absolute minimum credit history, according to the lender. Griffin Investment allows Credit ratings only 5850 to the Va lenders.

New Virtual assistant in itself does not place an essential lowest credit score because they’re maybe not the ones giving new finance.

Earnings

Loan providers also make sure your income in certain implies. So it implies that you have the income to invest right back the new loan. Loan providers is ask for lender statements, taxation statements, and you will spend stubs to ensure one earnings you let them know from the on your Virtual assistant application for the loan.

Brand of Va Mortgage Software

Stepping into property was better at your fingertips which have an Idaho Va mortgage. But not, you might check out the different types of funds offered to you. They might be:

Submit an application for good Va Loan into the Idaho

A good Va loan would-be best for you if you are searching to have an Idaho home loan during a finite funds and you are clearly helping or provides served in america armed forces. Griffin Resource are satisfied to help you serve military participants because their leading Idaho lenders that assist get this process a confident sense. We could you secure a great Virtual assistant loan into the Boise, Meridian, and a lot more.

Prepared to initiate the new Virtual assistant application for the loan process? Over a software online to start the entire process of buying your household or take advantage of your own Va experts. If you want to discover more about our very own Va software, excite e mail us today.