After you have went beyond the excitement of getting your first house, it’s time to get down so you’re able to steel tacks together with your buying offer. While you are these types of agreements can appear challenging, there are various fundamental parts you need to select, and another of your best anything on your own concern listing is always to end up being your contingencies. You are inclined to waive or clean out such contingencies so you’re able to sweeten the offer on the sellers, otherwise since you think they are unnecessary, however, customer beware. Contingencies can be found in destination to manage your, and several shouldn’t be missed. Here are some our very own checklist lower than out-of contingencies that you need to always keep in your own contract, so you’re able to purchase your first home instead care and attention.

Check Backup With a check contingency on your pick bargain should never be missed for almost all causes. With which on the agreement will give you legal influence to emptiness sales in case the house does not satisfy their standard having a safe and healthy domestic. Given that promise is that they look for nothing wrong to the household, using an expert inspector can get allow you to put major unseen circumstances inside the property before it will get your personal. If the troubles are discover, the fresh new check contingency allows you to right back outside of the sales, feel the resolve produced by the seller ahead cash advance in Nathrop CO of closing otherwise negotiate the price of our home and come up with up to own region of one’s charge you usually sustain fixing they your self.

When you are that it clause on your offer, you may have an out in the event the mortgage falls due to, and you’re perhaps not caught footing the balance in place of a mortgage

Because a house is actually for selling getting a specific rate does not mean that it is well worth anywhere near this much. Whether your financial asks for an assessment, he or she is inquiring a completely independent professional to build an excellent worth for the home based to your of numerous issues. If that well worth is actually far beneath the price of the house, their financial will most likely not approve the loan. In fact, they’ll probably simply accept financing to precisely what the house appraised having, therefore just like the buyer would-be accountable for creating the difference. Having this backup on your own contract enables you to lose on your own in the situation should the household maybe not appraise on inquiring rate, and it also will provide you with an opportunity to negotiate the cost to the supplier.

Assessment Contingency While this one is most significant for the financial, it is extremely a very important backup getting for your requirements

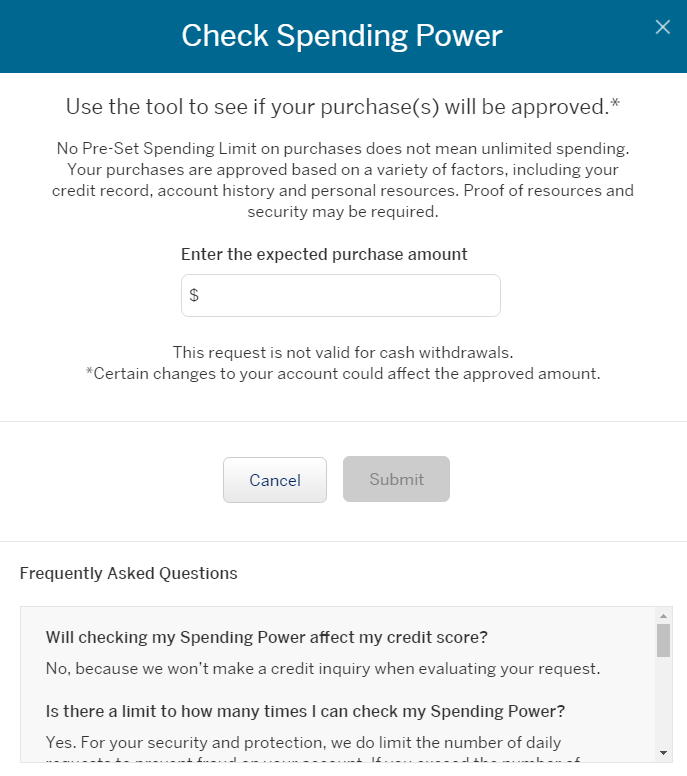

Financial support Backup Unless you’re to buy a property in the cash, extremely home buyers you would like resource to invest in a property when you look at the North Carolina. That is where a money backup will come in. Using this type of on the bargain, the acquisition of the house depends on regardless if you are able to acquire investment to buy they.

Other Contingencies to adopt If you are check, appraisal and financing contingencies will be the three vital clauses having in your offer once you purchase a house, he’s from the the actual only real of them you should know. Additional of them you might include try:

- Insect examination

- Sewer check or well check

- Shape, radon, asbestos or direct-depending paint assessment

There are various things to consider when creating your residence buy offer, and you will a dependable real estate agent makes it possible to browse courtesy them. The fresh NC Property Money Company hosts a list of popular actual estate agents who’re well-trained from the Agency’s reasonable property circumstances, which can help you make sure you can buy a home your are able.