Buying a commercial possessions can be a frightening task. Really people choose bringing financing regarding a bank or a keen NBFC, however they are uninformed of processes and have now view it difficult to identify the right lender. No matter if they know the fresh intricacies of application for the loan strategies, it select mortgage for sale out of industrial property and you may mortgage to have purchase of commercial assets hard.

Commercial real estate transactions will be getting office space otherwise retail stores such as for instance stores or shop. They may be not as much as build otherwise currently occupied. Listed below are some things to remember when you are taking that loan for purchase away from commercial assets.

There are 2 an approach to submit an application for that loan for purchase away from industrial assets, we.e., on the internet and offline. To your on the web techniques:

Go to LTF site Navigate so you’re able to Industrial Property Buy part Click Pertain Today Enter the facts (Name/Address/KYC Information/Assets Info) Publish your earnings and financial recommendations Just click Fill out

You may also have fun with an eligibility and you may EMI calculator to locate a reasonable suggestion regarding your eligibility and EMI construction.For the traditional techniques:

In the event your submitted information and you can data is actually proper, a lender member will get in touch with one to show you from the techniques also to help you comprehend the payment build.

The fresh files expected to obtain that loan for purchase off an industrial home is largely dependent on the reason of money. You may think a long time and you will daunting. . Although not, the new documents necessary for salaried experts, entrepreneurs, and pensioners are an identical. He could be:

Pan cards, Aadhaar credit or any other KYC files Income tax efficiency for the past three years Lender statement going back ninety days Income slip, pension comments and you may tax calculation sheets during the last 6 months Possessions documents, such as transformation action, conclusion certification, builder’s details, encumbrance certification, etc. Title evidence Target facts

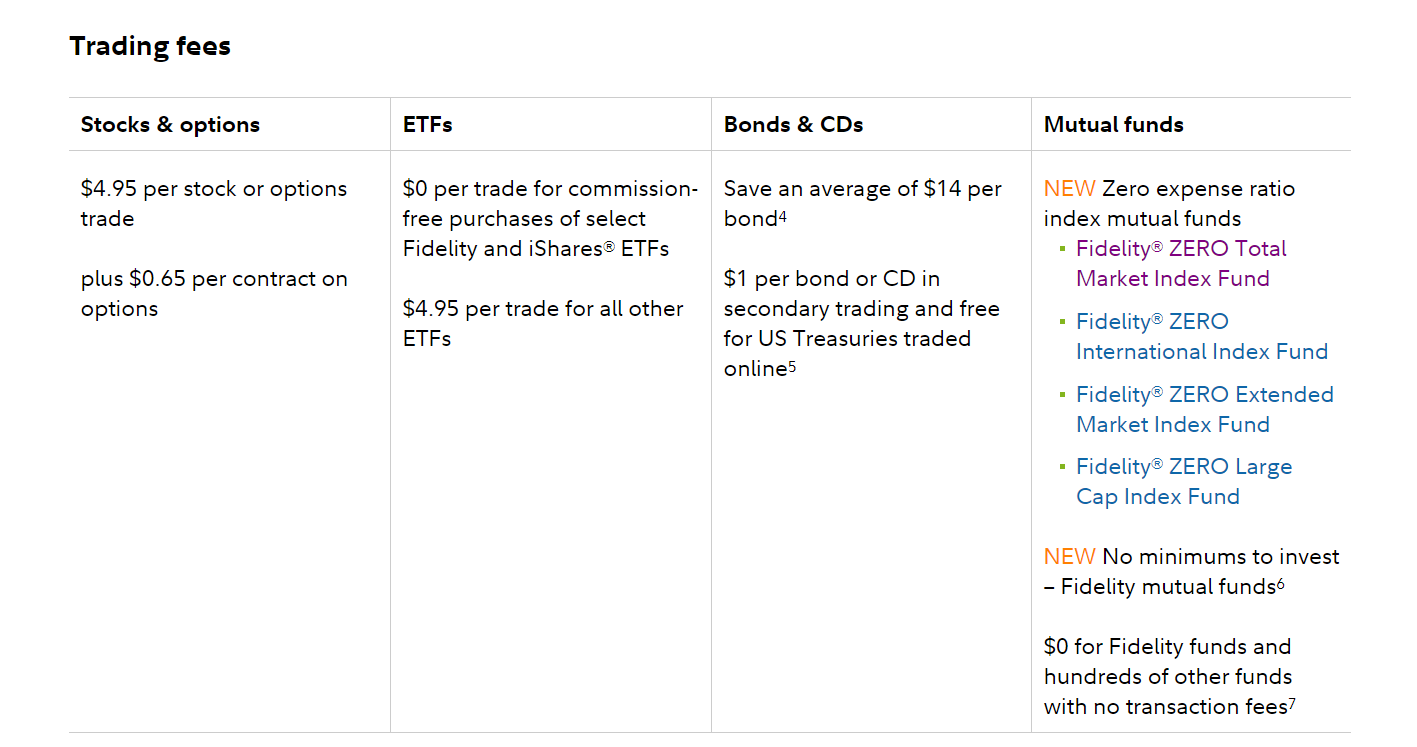

Rate of interest and you will charge

The attention costs towards the financing for purchase away from industrial possessions begin away from 9.50% and can wade upto 15% for salaried anybody. To have mind-working anybody, they start from nine.15% and you will wade upto 18%. The eye cost count on the credit and money character off the consumer as well. Even better, the new operating fee and you may costs including start from lender so you’re able to lender. Typically, new control percentage begins off 5% and you can go upto 7%.

Qualification Standards

The latest candidate have to be about twenty five years dated without over the age of 70 decades Brand new applicant have to be an Indian resident which have appropriate records Have to have a constant really works reputation of at least three years

Affairs affecting the borrowed funds processes

The newest eligibility standards when planning on taking that loan for sale regarding industrial possessions and you may circumstances affecting the loan to buy out of commercial property are:

Charges and you can charge The quality running fees your industrial home is step one% of one’s total loan amount. Some banks also can charges the very least commission out of 0.5 %. LTV (Loan so you can Worth) The new LTV ratio is the part of the borrowed funds matter put out than the total value of the property. It may be 75-90% to own land but just 50-55% having commercial features. Consequently customers need build a dramatically larger downpayment in the latter instance. Reputation of the developer Financial institutions and you can non-banking financial organizations (NBFCs) are involved concerning the developer’s reputation and you can reputation, particularly if online payday loans Nevada the industrial property is nevertheless around design. Before giving the mortgage to buy off industrial property, loan providers examine the fresh new builder’s delivery plan. Rate of interest Interest levels towards the mortgage for sale out-of industrial possessions is also depend on cuatro-5% greater than rates for homes, with regards to the borrower’s credit score. Tech criteria The commercial building need to comply with most of the necessary laws and regulations, as well as flame defense, civic facilities, elevators, shafts, and you may escalators, and also other factors for example staircases and you will emergency exits. Loan tenure The average repayment title of your own mortgage for purchase off commercial house is usually to have ten-15 years. This means you are going to need to spend increased EMI each month. The brand new property’s valuation The last loan amount hinges on the price of to find the economic assets. The lending company takes into account a decreased valuation said by the independent agencies. Age of the house or property The deficiency of approved advancement plans or any other necessary elements such as for instance as the flame exits succeed difficult to secure financing to own dated houses. City Loan providers will believe giving financing to own the absolute minimum area during the sq ft. Lenders might have lowest standards, which means that they may only give financing for areas larger than three hundred square feet or five-hundred square feet.

Harmony Transfer

Customers also have a choice of transferring an existing mortgage from one lender to some other. That it generally facilitates reorganizing current financing, such as for example quicker EMIs, prolonged tenures, an such like. Brand new paperwork continues to be the same as one to to possess a different financing and more than banking institutions provide comparable rates of interest in order to present consumers.A loan to buy of a commercial house is only necessary if you have a top paycheck otherwise money to pay for higher advance payment to pay EMIs over a good faster period of time. Having entrepreneurs and professionals, committing to a professional house is a great and strategic thing to-do, as they possibly can:

Establish the workplace about possessions Rent otherwise lease it out so you can a company/individual Think of it as a financial investment market it at the a great good prefer Get taxation benefits of upto 29%

At the same time, your aim is to dedicate smartly so you can secure earnings as well as acquire financial support like.

So, if you want financing purchasing commercial possessions, L & T Money provides certain financially rewarding income. Implement now!