Soon after you receive the loan pre-recognition, expect you’ll discover records to possess an effective conditionally accepted mortgage. You to status would-be on exactly how to obtain something special page. This happens an individual makes it possible to create your get, normally from the chipping into the deposit costs.

When someone try assisting you to, you need to ask for the latest resource far ahead of time. Deposit they. Allow it to season on the be the cause of more than a few (preferably about three) account statements. Like that, if for example the financial pro requires to see the quality a few months out-of bank statements, the cash might be absolutely nothing new.

If the provide import is found on your own recent financial comments, your home loan pro commonly request an explanation. How performed that money infusion arrive at your finances? What is the way to obtain the income?

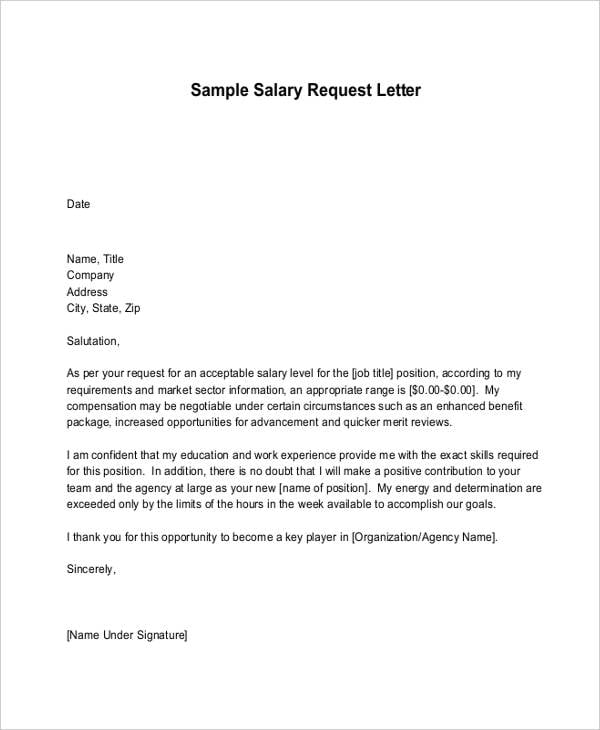

What a gift Page Is always to Incorporate

This new present letter is an easy, one-webpage declaration having the main information on the cash import. Your own mortgage pro provides you with a theme toward letter. Rescue financial facts: an image of the latest consider additionally the transfer regarding the provide donor’s checking account.

The financial professional can get consult all of the records tracing the transfer, and will request a bank report out of your donor. Why? The financial institution wants to comprehend the reputation of the funds within the the newest account they originated in. This indicates your money could have been legitimately obtained.

- A concept on top, certainly presenting the brand new file since the Gift Letter.

- The donor’s title, done target and you can phone number, and you may relationship https://paydayloancolorado.net/florissant/ to the new borrower. That is most often qualified? Anyone associated from the bloodstream, wedding, adoption or custody, wedding, otherwise residential partnership. No team active in the real estate deal.

- The degree of new current.

- The target of the home becoming ordered.

- The latest provide donor’s source of loans: title of financial institution; account number and what kind of membership its; therefore the big date on what a financial look at to the is actually (or could be) gone to live in the loan applicant’s escrow membership.

- New dated signatures of current donor and you may family customer.

Essential of all: The new donor are signing a statement you to zero installment, in both money or functions, is expected. The lender needs to be sure (a) you aren’t and when a special personal debt when finding money; and you will (b) your current donor does not have any lienable claim from the property.

There can be a common-feel explanation to own (b). You only need to believe such as a lender to determine it. The financial institution, having to cease risk, can potentially think a dispute along the currency will eventually once closing. Can you imagine the brand new argument resulted in the person who provided your the money to make a claim for the household identity? A gift letter reveals that the latest donor is one to – and also zero vested need for the value of our house.

As to why a gift Letter Must be Truthful

If you have to afford the cash back at the some later date, it’s just not a present. The new underwriter needs to matter it obligations on your own loans-to-earnings (DTI) ratio.

Zero strings affixed? Then donor will be invest in submit something special page. Towards the bottom, you will have a gap both for donor and receiver so you can approve the comprehending that its a national crime, having major penalties, to help you consciously misrepresent its aim.

Right here, a debtor you are going to inquire exactly how anyone create understand. As well as how carry out individuals maybe fees a great donor or receiver which have a federal offense while the offer is more than?

It can happen. Individuals have jobs loss, family emergencies, medical incidents, or other situations conducive so you’re able to financial setbacks. Specific money fall into home loan standard. Some home owners face foreclosure otherwise case of bankruptcy. Throughout the unfortunate feel off suit, courts will check documentation brand new homeowner used to get the home loan. And in case misrepresentations were made, might emerged.

Talk to your own home loan professional about the most useful sorts of financing to suit your situation, as well as your intention to utilize current money. Getting a basic suggestion, standard sorts of money apply this type of conditions:

- Old-fashioned fund compliment of Fannie mae and Freddie Mac computer: A present out-of a relative is funds a complete down payment to own an initial residence. Freddie Mac computer in addition to lets mortgage applicant to use previous matrimony gift money from relatives and family relations.

- The new Federal Homes Government (FHA): Something special of cash is acceptable out-of a relative, commitment, workplace, buddy, otherwise nonprofit business. The money normally sourced out-of a community organization one to supports first-time home buyers otherwise reduced- so you’re able to reasonable-income buyers.

- Department off Pros Items (VA)and you can U.S. Institution away from Farming (USDA) loans: Va and you may USDA money officially don’t require a downpayment. Gift ideas and current characters continue to be are not permitted to fund off payments for those requests.

In a nutshell, very mortgages support gift currency to pay for a complete off percentage for the a first residence. Financing regulations is more strict to the purchases regarding funding attributes.

Professional idea: Your bank may permit you to fool around with gift currency for mortgage supplies, while you are trying to get a normal financing. Present currency over and above what’s needed to your down-payment are brought so you’re able to supplies into the an FHA loan. Ask your home loan professional otherwise financing administrator to own newest guidance to help you suit your individual disease.

Tax Factors to have Provide Donors

If the giving over $15,000 ($31,000 to have combined filers) to your you to definitely recipient, the new donor has to claim the new provide into Internal Money Provider. When filing taxation statements to your 12 months the brand new provide page try closed, the fresh donor should utilize the federal present revealing setting to help you statement the latest import off funds.

The fresh donor won’t spend income tax towards the gift money. However, offering does have taxation implications, no less than on paper. It is deducted about life gift count a man may offer tax-totally free. So, the fresh new donor need to consult an income tax top-notch to have suggestions.

A number of Final Conditions into Smart

After you’ve your own conditional approval, end while making huge places into your profile (such a weird deposit of over half your month-to-month earnings) up to when you close in your new possessions. Remember that loan providers reexamine their property in the event the two months go by because they earliest examined the a few months out-of lender comments. Higher deposits in the bank account are leads to.

It’s advisable that you explore a gift (and something special page) on condition that you really need it discover that loan. It is also best that you comprehend the current letter’s goal out-of a good lender’s viewpoint. So it insights makes it possible to keep away from judge dilemmas. It also helps you have made one last mortgage approval…directly on date.