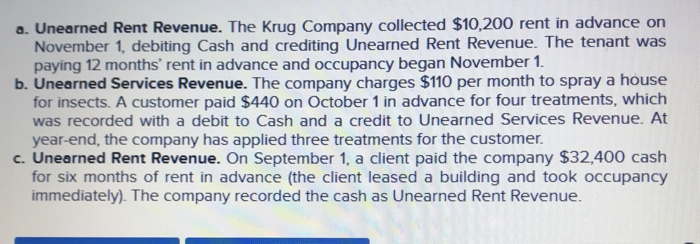

Envision a connection Financing in a great Seller’s Field: From inside the good seller’s business, where qualities are offering quickly, temporary money can give you a competitive edge. From the securing immediate cash circulate, you possibly can make an effective offer into another type of house, possibly increasing your possibility of protecting your ideal possessions.

Give particular monetary advice

Specific monetary info is critical for a successful application for the loan. Be ready to bring evidence of earnings, an excellent expenses, or any other relevant monetary files to help with the loan software.

Talk to your lender

Unlock communication along with your lender is key. Make sure to understand the fine print of one’s financing and ask any questions you really have. Their lender provide valuable recommendations about mortgage process.

Consider carefully your month-to-month finances

Prior to committing to a home loan, meticulously examine your own month-to-month budget to be certain you might easily pay for the new monthly payment. Capital shouldn’t place significant financial strain on your own monthly earnings.

Does credit score subscribe to protecting a bridge mortgage?

It is really worth listing one to link financing end up in small-term money, and thus, the credit rating demands may not be while the strict because might possibly be to have a timeless financial. Yet not, a good credit score is still a secured item in the event it involves protecting a mortgage.

If the credit history is gloomier, it doesn’t necessarily mean you simply will not qualify for a link mortgage. Specific loan providers offer connection loan choices created specifically for those with all the way down fico scores otherwise less conventional borrowing records.

And work out Your upcoming Economic Circulate having Connection Funds

To summarize, a proprietor-occupied connection financing will be an invaluable capital solution if it involves while making your following financial disperse. Regardless if you are to acquire another type of household, an additional home, otherwise you would like temporary homes, connection money also provides immediate cash flow, connecting the latest pit within latest household deals and you may brand new home pick. With short-term financial support, you could potentially secure your dream house without having any financial burden out-of balancing one or two mortgages.

Such resource give an adaptable financing choice, letting you link the brand new gap between your newest home revenue and you can new house get, providing a softer transition on your a home excursion. With immediate cash circulate, property owners can take advantage of business opportunities, safer an alternate domestic, and give a wide berth to the stress from timing property revenue really well. Because of the expertise terms, rates, credit history conditions, and costs associated with link funds, you could make an informed decision on whether or not this is basically the right fit for your financial requires.

Whether you’re thinking of buying a different sort of domestic, safer short term construction, otherwise spend money on the next property, brief investment also provide new economic services you prefer, allowing you to help make your next step with full confidence.

Was a short term connection financing high-risk?

Bridge funds is deemed higher risk versus traditional money since they’re typically small-name, has actually large interest rates, and could want collateral. The danger on the short term financing generally arises from this new short period and possibility a borrower so you’re able to standard towards payment. But not, connection funds normally a good unit for individuals otherwise enterprises in some situations in which they need quick capital ahead of securing long-term resource.

- Once your newest home is sold, the fresh proceeds are used to pay off the latest “new” loan. Which means that your own bridge mortgage was a short-term services, with a definite log off method when your house revenue is completed.

Stress-free Change: Sometimes, you will need brief construction if you’re waiting for your house get to be completed. Pursuing the acquisition of an excellent “new” family, borrowers can sell their established home at a very relaxed pace. It does away with stress of getting to handle multiple moves and you may allows these to get the very best price on their present house. This will render reassurance and comfort for the transition period.