Collection expansion: Using money from a good HELOC on a single assets allows you to quickly grow your profile. Youre using currency that you just weren’t carrying out one thing having and you may generating a projected a dozen so you’re able to twenty four per cent towards a different sort of pick. Toward any after that deal you intimate, you are growing your own portfolio. The good thing is that you are trying to do they with your personal funds and on their words.

Penalties & fees: Continually be bound to browse the fine print when using a HELOC loan

Income tax masters: The attention that you shell out toward good HELOC is actually taxation-allowable if you itemize the deductions. When you are a single filer you might subtract up to $50,100 of the appeal paid off, if you are if you find yourself married and you will submitting as you you could deduct up to $100,100000 of interest paid down from the taxation.

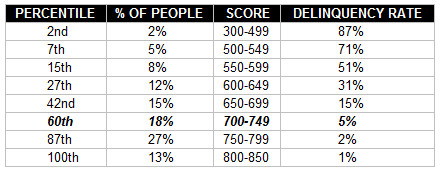

Boost credit history: By taking out a beneficial HELOC, youre generally opening up a different credit line. Build your money on time, and you you are going to improve your get through the years. This is exactly a great way to help you positively sign up for your overall get.

Flexible use: HELOC’s are not earmarked to have unique intentions. While many property owners make use of the loans to possess repair plans, that isn’t required. HELOCs https://paydayloansconnecticut.com/inglenook/ are often used to assist finance auto fixes, scientific expenditures, school funds and a lot more. You really have flexibility in the way you utilize your HELOC.

[ Questioning just how to loans very first money deal? View here to register for the Online a property classification where you could know how to start off in real estate paying, even with minimal finance. ]

Financing collateral: Perhaps the most significant disadvantage, or chance, of good HELOC is the fact your home is safeguarded while the guarantee. This is certainly an especially challenging danger proper having fun with an excellent HELOC on the number 1 house. Whatsoever, if you cannot generate financing costs, the financial institution you may foreclose into the property.

More mortgage payment: In the event their commission was smaller, it is still an alternate percentage toward assets. Inside the best community, you would use this line to enhance your business. Just what either ends up happening is that the range will get put to many other points. So in lieu of growing your business, you end up leading to your debt.

Balloon choice: The new HELOC is interested-only option with the earliest a decade. Since the no principle is actually applied during that time, it should be made up on then 10 years. The fresh monthly payment often is greater compared to interest-merely count. You could potentially spend your loan down or out of at any time during the the initial ten years, nevertheless the principal is put in the percentage next.

By maxing out of the range, you will lower your credit score because of the run out of regarding readily available balance

Equity prevention: In the event equity was an enthusiastic inexact count, it continues to be important. People the newest financing you receive try set in the amount due for the possessions. The greater security you may have, the greater amount of available options. Equity makes you sell otherwise re-finance when philosophy go up. In the event that philosophy change off and there’s no guarantee, you’re compelled to contain the property until something changes.

Centered on Andrew Latham, an official private loans specialist therefore the dealing with publisher off SuperMoney, you’ll find invisible fees people neglect whenever beginning a column away from borrowing. This is why, Latham highly suggests checking exactly how much the lender usually charges during the annual charge (it is normally up to $100 annually) and you may if they charges prepayment charges. Particular lenders tend to charges annual costs if not laziness costs in the event the the financing goes vacant. Also, pages should also make certain they are conscious of any penalties to have paying back the amount very early. Normally, the first closing payment is approximately $500 which will be triggered for many who pay back the HELOC and you may personal it just after just 12 so you can 3 years on the loan, claims Latham.