House security fund and credit lines are methods to utilize the value of your home so you can borrow cash. Discover the many solutions, the pros, as well as the dangers of for each.

- Utilizing the Guarantee in your home So you can Borrow money

- Household Collateral Finance Said

- Home Guarantee Credit lines Explained

- Closure to the a property Guarantee Loan otherwise HELOC

- Your own Right to Cancel

- Your own Legal rights Immediately following Taking an excellent HELOC

- Statement Ripoff

With the Guarantee of your home To help you Borrow funds

Your collateral ‘s the difference between your balance on your home loan plus the most recent value of your residence otherwise exactly how much currency you can aquire for your home if you marketed they.

Taking out fully a home collateral mortgage or getting property guarantee personal line of credit (HELOC) all are indicates individuals make use of the collateral in their house to help you borrow cash. Should you that it, you’re utilizing your house since the collateral to borrow cash. This means if you don’t pay off the fresh outstanding harmony, the lender may take your property because the payment to suit your obligations.

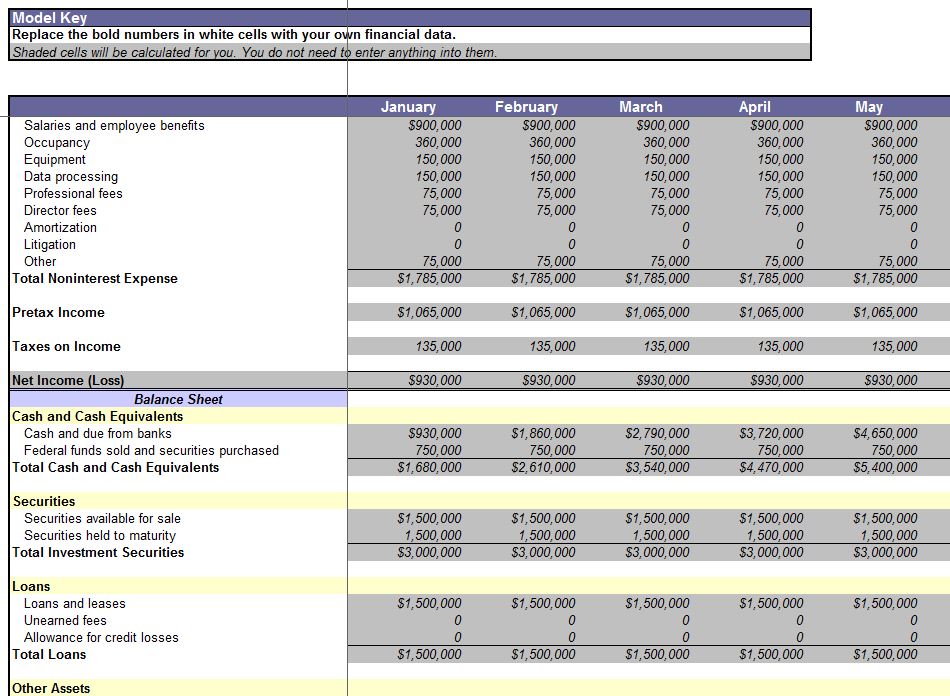

Like with almost every other mortgage loans, you’ll shell out attention and you can costs on the a property equity financing or HELOC. Whether or not you choose a home security mortgage or a good HELOC, the total amount you might obtain along with your interest rate all hangs for the two things, including your earnings, your credit score, plus the market value of your house.

House Security Finance Informed me

You get the mortgage to have a certain number of currency and you will always obtain the money since a lump sum payment upfront. Of numerous loan providers choose you use no more than 80 per cent of security in your home.

But if you like an attraction-only financing, your own monthly premiums go on the make payment on interest your debt. You aren’t paying down any of the dominating. Therefore will often have a lump-sum or balloon fee owed at the conclusion of the loan. The new balloon payment is frequently highest because it has the new outstanding dominant balance and you may one left desire due. Somebody may need an alternative financing to pay off the new balloon fee through the years.

Home Collateral Personal lines of credit Told me

A property equity personal line of credit otherwise HELOC, is actually a great rotating personal line of credit, like a credit card, but its secure by the house.

These credit lines routinely have a variable Apr. The brand new Apr is dependant on interest by yourself. It does not is will set you back like points and other resource costs.

The lending company approves your for as much as a certain amount of credit. While the an effective HELOC is a line of credit, you create payments just on the matter you use – maybe not an entire number readily available.

Of many HELOCs enjoys a first several months, named a blow months, whenever you can obtain on the account. You can access the bucks from the creating a check, while making a withdrawal from your account online, or using a charge card connected to the account. Inside the draw months, https://paydayloanalabama.com/mignon/ you could just need to spend the money for focus towards currency your borrowed.

After the draw several months finishes, you enter the cost period. For the cost period, you simply cannot obtain any longer money. Therefore must start paying the total amount owed – either the whole outstanding equilibrium otherwise as a consequence of money over the years. If you don’t repay the latest credit line as the agreed, your own financial can also be foreclose in your household.

Lenders must divulge the costs and you may terms of good HELOC. More often than not, they want to get it done when they leave you an application. For legal reasons, a loan provider need to:

- Reveal the fresh Annual percentage rate.

- Offer the fee terms and conditions and you can inform you of differences throughout the the fresh draw period and also the repayment months.