CalVet Home loans

You can find the fresh new CalVet Loan could save you currency and provide cover for your home and you can funding. CalVet has exploded qualification to make sure that really veterans (along with people now on the productive responsibility) trying to buy a property inside Ca qualify, susceptible to economic certification and you can readily available bond loans (select limits to possess peacetime-day and age veterans).

Several of veterans to find belongings for the California meet the criteria to possess a beneficial CalVet Mortgage, also experts who served throughout the peacetime. Only 90 days from effective duty and you will release classified as Honotherwiseable otherwise Not as much as Respectable Standards are essential. Guidance to ensure the qualifications are disclosed on your own Certificate off Release otherwise Discharge of Energetic Duty Mode DD214. Veterans currently into the active obligation meet the criteria once offering the 90-big date productive obligation criteria. An announcement out-of Provider out of your current command required. Latest and you will previous members of the new National Protect, plus All of us Armed forces Reserves, could be eligible of the fulfilling specific requirements.

CalVet can help you rating pre-recognized to suit your buy. A great pre-approval verifies that you’re eligible and economically qualified for a beneficial specified loan amount. Knowing the measurements of your loan will assist you to in choosing a property and you can negotiating your purchase.

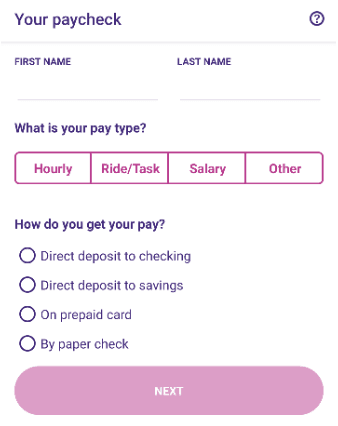

You can start the pre-recognition procedure because of the submitting a query on the internet in the CalVet webpages or you can obtain the program and you can fill out they by the post, facsimile otherwise email. After you’ve acquired an effective pre-recognition, you will understand how much you could potentially obtain, and stay willing to purchase your new home.

Stop by at begin the applying techniques. Shortly after responding a couple of questions, its system have a tendency to prove your qualifications. An effective CalVet affiliate tend to get in touch with you to give assistance that assist you through the app processes.

While already working with a mortgage broker, inquire further throughout the CalVet. If for example the broker isnt accepted which have CalVet they truly are acknowledged inside the application process.

CalVet’s restrict amount borrowed is dependent upon different loans in Theodore financing provides, such as the loan system otherwise property method of. CalVet also offers an amount borrowed you to definitely is higher than old-fashioned conforming loan amount limits. Locate latest limitation financing quantity, please visit our website or Contact us at the 866-653-2510.

CalVet financing charges are typically below charges charged some other authorities or old-fashioned fund. CalVet simply accumulates an upwards-front side capital percentage and won’t charge a month-to-month mortgage insurance rates superior, that will ask you for several thousand dollars across the life of the borrowed funds. By using the fresh new CalVet/Va loan program therefore the veteran has actually a beneficial 10% or more disability get, brand new capital fee is actually waived. Investment costs is actually at the mercy of transform. Please visit the latest CalVet web site or refer to them as for the most current suggestions.

CalVet costs a-1% financing origination percentage into the most of the financing. CalVet tends to make your loan less costly from the perhaps not recharging most lender charges.

Your connection with CalVet continues on immediately following loan closing from the servicing of your own loan. CalVet will bring on the web the means to access your bank account. When you go to their website, you could check in to gain access to your account on the web or you can name Financing Maintenance on (916) 503-8362.

Property

The latest CalVet Financial isnt a-one-day benefit. Should you have a beneficial CalVet financing in the past which had been paid in full as assented, you are able to apply once again.

- Fire & Possibility Insurance coverage on lower class prices

- Crisis Security For disturbance and you will flood wreck high coverage with low deductibles and you may lowest premium

- Affordable Category Life insurance coverage

- Single Family members Home

- Structured Device Improvements (PUD)

- Condos

- Are produced House installed on a permanent foundation