The new Supply

- Government Casing Financing Company (FHFA)

- Federal national mortgage association

- The newest Federal Association from Real estate professionals (NAR)

- Individual Financial Coverage Agency (CFPB)

- Government Put Insurance Company (FDIC)

- Anurag Mehrotra, secretary teacher of funds at San online personal loans MD diego State University’s Fowler College away from Business

- Holden Lewis, domestic and you will financial professional at the NerdWallet

The solution

A different sort of federal rule means homeowners which have large credit ratings you are going to see the costs on the latest mortgage loans improve, depending on their deposit count. Those with down credit scores will generally select their charge drop-off.

If you are people who have highest fico scores are getting an inferior crack than ever before, might still spend all the way down overall charge than just somebody with an effective down credit score.

That which we Receive

The newest Government Casing Loans Agencies (FHFA) is actually applying alter so you’re able to mortgage costs with the antique funds backed by Federal national mortgage association and you will Freddie Mac. When you take out a home loan throughout the financial, sometimes this type of regulators-sponsored companies are actually the of them promising it.

This new charge, which can be called financing-height rates improvements (LLPAs), is a portion of the home loan amount and you will centered on products like your credit score and you may advance payment. FHFA said the changes are included in the broader purpose to help you do a far more durable homes funds program and make certain equitable accessibility mortgage loans for more homebuyers.

Brand new LLPA change based on credit score work for money securitized prior to , NerdWallet domestic and you can financial specialist Holden Lewis told you. As it does take time to help you securitize mortgage loans, individuals have-been spending these types of current fees because the center off March and/or beginning of April, depending on the financial, he extra.

The alterations along with do not effect mortgages which can be covered otherwise guaranteed by the other firms, like the Government Housing Administration (FHA), this new Agencies off Veterans Facts (VA) or even the Company out-of Farming, Lewis said.

Within the brand new government laws, of many homebuyers with higher credit scores just who build off costs between 5 and you will 31% will find the charges increase compared to current cost.

However the FHFA states brand new up-to-date fees dont represent pure decrease to possess high-risk individuals or absolute expands to possess lowest-exposure consumers.

Of several consumers with high credit scores or highest down money often discover the charges fall off or remain flat, the newest institution additional.

Despite the payment alter, homebuyers having large credit ratings often nevertheless spend down overall charges than just anybody having a reduced credit score, casing and you can mortgage experts advised Guarantee.

Higher-credit-rating consumers aren’t getting billed way more you to definitely straight down-credit-rating individuals pays reduced, FHFA told you. The fresh current charges, just like the try genuine of your previous charge, basically increase once the credit ratings fall off for any provided number of deposit.

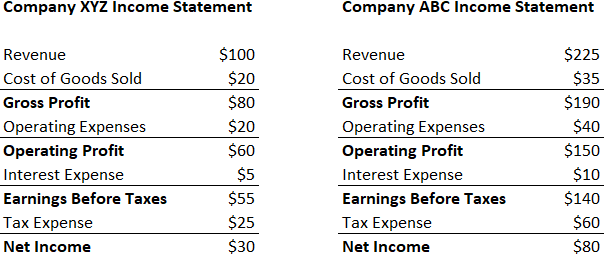

Like, you aren’t a credit rating of 740 whom makes a beneficial 20% downpayment for the a home accustomed shell out an LLPA fee from 0.5% toward overall mortgage worth. Now, according to the brand new statutes, their payment increases so you’re able to 0.875%.

A person with a credit score from 640 which places 20% down have a tendency to now spend a reduced LLPA payment from dos.25%, as compared to early in the day percentage out-of 3%.

Though the LLPA fee decreased for someone with a credit get away from 640, their costs are nevertheless greater than those people with the homebuyer having a great 740 credit history.

There are also issues where LLPA fees get rid of to have buyers having each other large and lower credit ratings, depending on its deposit count.

Instance, one or two consumers with the exact same fico scores regarding over circumstances would come across its charge miss once they result in the minimum off percentage from 3%.

Beneath the old commission construction, a great homebuyer having a credit rating of 740 could have reduced a charge away from 0.75% compared to 0.5% today.

A purchaser having a credit history away from 640 might have paid down 2.75% within the dated guidelines. Today, it spend a-1.5% commission.

Mortgage lenders often grounds LLPAs on a borrower’s interest rate getting the home loan, in place of battery charging them a primary commission, Anurag Mehrotra, an assistant teacher regarding funds during the San diego Condition University’s Fowler College out of Company, explained.

Such, if for example the LLPA charges is actually step one% of your home amount borrowed, the lending company you are going to enhance your interest from the 0.25% rather, Lewis told you.

However, people who have high credit ratings plus be eligible for all the way down focus prices to their mortgage loan, preserving all of them money in the long term.

Brand new fee construction might look like it’s more economical to own homebuyers while making reduced down repayments. But FHFA claims that’s not the way it is.

Borrowers who generate an advance payment out of less than 20% have a tendency to have the added cost of individual home loan insurance coverage (PMI), new department said. Anybody normally pay for their PMI by way of a monthly superior that’s put in the homeloan payment.