Are you currently which have trouble spending your financial? Maybe you’ve already defaulted? If you’d like to keep family you will want to check out bringing a loan modification to avoid foreclosures while having your own home loan returning to normal. Financing amendment may even end up in a diminished monthly payment and you will principal forgiveness otherwise forbearance.

To track down that loan modification you’ll need to work with the mortgage servicer, the team which will take your instalments, loans your bank account, and forecloses on you once you end spending.

However your servicer is not always the owner of the loan. This is the individual, plus they are the one that comes with the ability to accept or refuse your loan amendment application.

Specific people, particularly Ocwen, only service money, plus don’t invest in people funds. But some banking institutions, eg Citi (aka Citigroup or Citibank), could well be both the servicer away from and buyer during the a home loan, or just you to and never others.

Citigroup is amongst the larger five banking companies regarding U.S. together with Wells Fargo, Financial out of The usa, and you will JPMorgan Chase. Citi is actually working in a lot of mortgage loans, many of which has defaulted on on one-point. There is assisted of several property owners that a mortgage with Citi save yourself the their property courtesy a modification.

1. In the event the Citi is the buyer on your own loan, it does not matter just who the fresh new servicer was, you are required to qualify to have a good HAMP modification in the event the you may be eligible.

Banks you to acquired bailout money from the federal government are required to evaluate qualified individuals for the government’s HAMP program. Citi, like all of your huge banking companies, took billions throughout the regulators immediately following running into huge losings inside financial crisis, and that must think qualified property owners to possess HAMP loan adjustment.

- You are having problems and come up with your own home loan repayments because of a appropriate hardship.

- You’ve got defaulted or are in danger from losing trailing toward your financial.

- You got their financial into or ahead of .

- Your home is maybe not become destined.

- You borrowed from as much as $729,750 on your top household.

dos. When the CitiMortgage is the servicer, along with your individual try a private establishment, they’re not required to consider you having a great HAMP amendment.

CitiMortgage ‘s the repair arm out-of Citigroup. They may services the loan for the next investor you to possesses your loan. Individual investors usually do not participate in HAMP. They’re able to choose bring inside the-domestic mods, but they does so on their terminology.

step three. CitiMortgage can offer your a call at-home amendment if you are not entitled to HAMP.

In the event the CitiMortgage will be your servicer, however you features a personal buyer otherwise are not entitled to HAMP, you can be analyzed due to their during the-family modification system entitled Citi Amendment.

4. There are a variety from other loan modification meaningful link solutions, with respect to the insurance carrier/guarantor/trader .

CitiMortgage’s web site states that we f your loan are insured, secured, otherwise belonging to Fed eral H ousing Authority (FHA), United states Agency off Agriculture (USDA), Rural Property Qualities (RHS), Veterans Administration (VA), or any other individual, you might be permitted become evaluated getting an amendment certain to people types of loans.

Financing modifications are usually really the only solution a struggling homeowner has actually to keep their property. You will find additional possibilities dependent on your loan servicer and you may trader. Check out history what you should keep in mind.

HAMP is actually expiringis expiring . The job have to be within the of the you to time, and the modification have to be effective towards or just before . Big date try running out. If you think that you might take advantage of a great HAMP mod, the time has come to make use of.

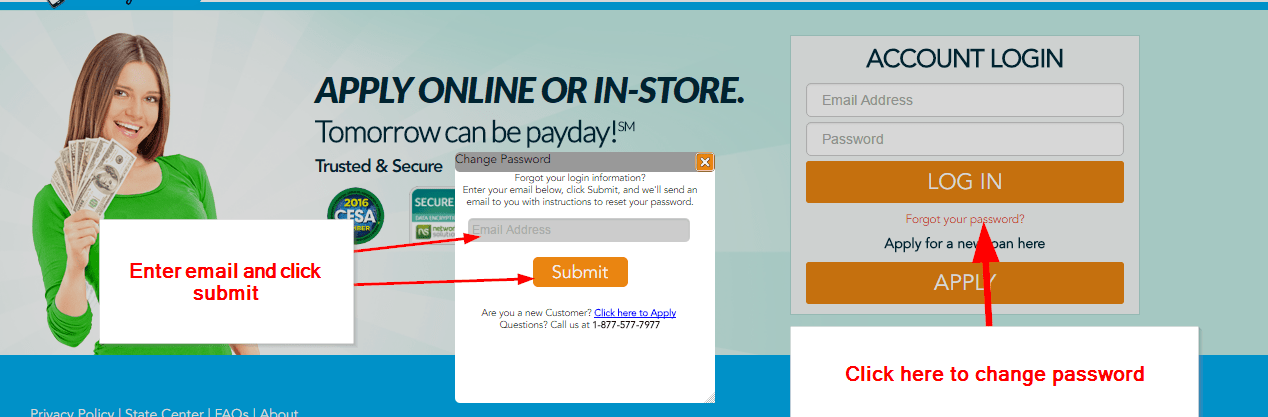

Mortgage modifications aren’t normally recognized instead way too much documents getting published to the borrowed funds servicer. Citi possess a reputation to be like requiring from the count papers needed. It’s loads of performs, and some of the people just who apply on their own is actually denied.

You might maximize your odds of a positive result of the operating which have an attorney which understands the borrowed funds amendment techniques. A talented attorneys also can safeguard you against foreclosures when you find yourself a beneficial mortgage loan modification has been pursued.

Once more, we have assisted of several people who possess a home loan that have Citi cut their their residence using an amendment. Y ou are able to see a few of the successful Citi circumstances performance right here.